I’ve been developing a smart contract-driven FX trading system aimed at demonstrating improved efficiency, transparency, and auditability for central bank-managed foreign exchange (FX) markets. The project currently leverages DAML smart contracts to enforce FX trade execution, compliance, and liquidity management - with allowance for the use of DAML triggers and other on-ledger automations in the future.

The project is currently offline but more information about the vision can be seen here([Vision: v0-bo-g-fx.vercel.app]( v0 App -Process Charts)),

and here v0 App

and here (https://v0-bo-g-fx-5lm66d.vercel.app/)

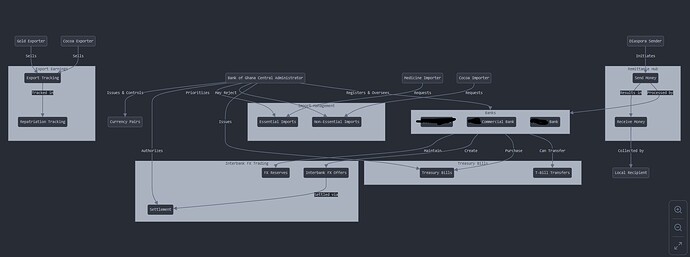

The transaction graph made available by daml script (as the sole datasource for the vercel webpage) demonstrates how interbank FX trades, remittances, and liquidity reserves can be handled securely and automatically. With this milestone, the core functionality is communicable, and the system is at a stage where it can be taken to the next level.

The Transaction Graph – What’s Working?

1. Smart Contract-Driven FX Market Transactions

The DAML transaction graph captures and enforces:

- Bank Registration & Permissions: Ensuring only approved entities participate.

- Currency Pair Management: Defining and updating FX rates.

- Liquidity Reserve Management: Tracking USD, EUR, GBP, and GHS holdings across banks.

- Interbank FX Trades: Automating FX offers, acceptance, and settlements.

- Remittances & Treasury Operations: Managing cross-border transactions and government securities.

2. Secure & Transparent Audit Trails

Every transaction—whether an FX trade, liquidity adjustment, or remittance—is recorded immutably with cryptographic signatures. This design ensures compliance with:

- AML/KYC requirements through automated validations.

- Central bank governance policies with built-in role-based access control.

- Regulatory reporting standards, with timestamped, traceable records.

What’s Next?

The major challenge at this stage is developer resources and expertise to further:

- Expand the FX trade logic with more sophisticated liquidity mechanisms.

- Integrate with global payment networks (e.g., SWIFT, CBDCs, Stablecoins).

- Enhance AI-driven risk management and market analytics.

Open to Collaboration

With the transaction graph and core codebase functional, the project is at an inflection point where it can evolve into a scalable financial infrastructure solution. I’m open to:

- Technical feedback from the DAML community.

- Developer collaborations to refine and scale the system.

- Investors & partners who see potential in bringing better FX infrastructure to central banks and financial institutions.

If you’re interested in discussing next steps, feel free to reach out. Looking forward to insights from the community!