Elaborating a little bit more on the meaning behind this code, we need to consider what money is. Let’s take a step back, through history.

At some point, people decided that gold was valuable. (Don’t ask me why.) But transporting it was inconvenient (it’s heavy), so people decided to trust “banks” to hold their gold for them, and when they needed to pay, instead of giving other people nuggets of gold, they would give them signed papers that said “you can go and take gold from my account at this bank”.

As time went by, standardization occurred. Countries decided to create central banks, and commercial banks decided to trust central banks to hold their gold. Over time, people got comfortable with the idea that a note that allows you to take gold from a bank account is pretty much as good as the gold itself, and actually exchanging notes for gold became more and more rare. People just traded the paper notes directly.

Then the central banks decided to get rid of their gold, and nobody noticed. People just kept trading stuff and services for paper notes.

Anyone can take a piece of paper and write “100 USD” on it. But we’ve all agreed that we only trust the US Federal Reserve to print “valid” USD notes. Similarly, we’ve all agreed to trust the European Central Bank to print “valid” Euro notes.

Let’s ignore the possibility of fraud and assume that signatures can easily be checked for validity. If I come to you and give you a note that says “100”, you will give it a different value based on who signed it: if it was signed by the US Federal Reserve, you’ll take it as being worth 100 USD. If it was signed by the European Central Bank, you’ll take it as being worth 100 EUR. If it was signed by me personally, you’ll have to decide for yourself how much trust you put into that. Maybe I have a really good reputation. Maybe you’ve never heard of me.

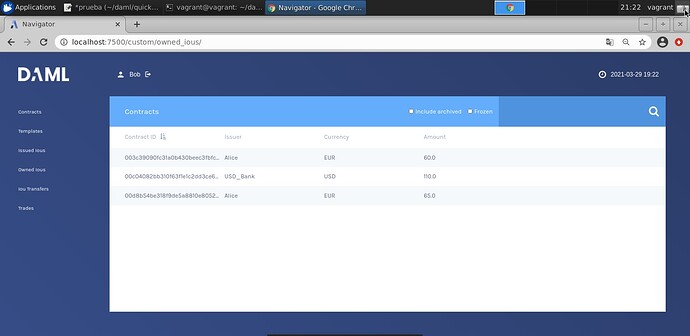

This concept of “who signed it”, fully separate from “who currently owns it”, is what the “issuer” in that template represents.

In princple, there is nothing special about the US Federal Reserve, and in a Daml system, they would just be another Party. It’s up to Bob to decide which issuers he trusts.

So what’s the value-add from Daml? In this case, the value is that if Bob trusts Acme Bank (the issuer), Bob does not need to trust Alice (the current owner) in any way to be confident that the money he is receiving is valid, has not been double spent, etc.

This is pretty much the same situation as in the real world (except forgery is much harder): you can trust a $100 note not because you trust the person who gives it to you, but because you trust the US Federal Reserve (and the fact that they engineered those notes to be hard to forge).

With this additional context, hopefully it should no longer be surprising that Alice can create as much money as she wants. It’s just that the issuer for that money will be Alice, and presumably not many people will decide to trust her on that.